How strange it is with all the recent talk of Housing Benefit cutbacks and benefit caps that no one has put their finger on the real problem. High rents as a result of a boom based on property price inflation which stoked a demand for imports that was unmatched by production of wealth.

When I first claimed supplementary benefit as it was then called (rent was also paid then by the SS) there were fair rents in unfurnished premises. Parasitic landlords couldn’t just hold people who need a roof over their heads to ransom, reaping vast rewards for no effort. But Thatcher abolished rent control for private tenants along with selling off council housing. Tony Blair at one time asked why rent controls weren’t being reimposed but when New Labour came into office, the free market was let rip and now we seen the consequences. If the Housing Benefit bill needs to be cut then landlords ability to increase rents beyond peoples’ ability to pay should be stripped away.

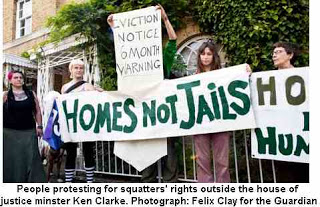

Better still, everyone should have a right to a home, squatting an empty property should be made specifically legal and there should be an end to a market in housing, the most essential of all things bar food that human beings need to live.

I have also added a contribution from Bernard Ready, who is associated with the ukhousingpolicy.com website, he kindly sent a response to Dave Parks who has asked me to include it. As Dave says: ‘He clearly knows more about the subject than I do – I think his comments greatly addd to an informed debate and he has given me permission to circulate his comments.’

Tony Greenstein

There has been a lot of fuss recently about high level benefit payments. One major component of high benefit payments is costs in terms of Housing Benefit for the unfortunate people stuck in private sector housing.

I’m struck by the fact that you can often see “To Let” signs on the council estates around Exeter were I live. It strikes me that there must be a significant proportion of council houses that were purchased using “Right to Buy” that are now in the hands of the private sector profiteers – people who own numerous properties who let them at exorbitant rents.

New Labour has apparently bought into the feeding frenzy about the enormous cost of Housing Benefit on society. See for example:

I agree that it is an outrage that so much money is expended in making a small proportion of the population stinking rich by exploiting the low paid and the unemployed. There are a vast number of people who can’t get housed by the Local Authority and who can’t afford to buy their own home. They have no security of tenure and a vast proportion of their wages goes into making someone else wealthy.

Protected Tenancies prior to the 1986 Housing Act allowed tenants to have both security of tenure and the right to demand that the local Rent Office determine a Fair Rent. A Fair Rent was a legal maximum rent that a private landlord could charge. My personal experience of getting a Fair rent fixed in the early 80s was that my rent was more than halved. In a household of 5 people this saved the tax payer a lot of money in terms of housing benefit for those that were claiming housing benefit and for the rest of the tenants their living stand on a low pay increased substantially. These days private sector tenants pay a ridiculous proportion of their income towards rent and they don’t even know whether they will have the right to remain where they live 6 months later – it is a disgrace!

I have some questions for which I would love to see some answers, does anyone know the facts and figures:

Around 2 million council houses were sold using “Right to Buy” between 1980 and 1998.

1. How many of these are Owner Occupied and how many now privately rented?

2. What is the additional cost to the tax payer of former council properties being privately rented in terms of increase to the housing benefit bill?

I know these look like simple questions and there may be more complicated pictures behind them. For example it may be more constructive to look at the total number of properties in 1980, those council owned, and those owner occupied and those privately rented and compare with the figures today and then take into account Housing Benefit costs.

Also how many people are in a poverty trap where they can’t get council housing and can’t exercise “freedom of choice” to buy their own home?

There is an ideological battle over the benefits bill. Part of this relates to Housing Benefit. I don’t think we should defend the status quo. It is an outrage that so many people are super exploited by being damned to the private sector. It is a scandal that there is so little public housing. I wonder whether it would be true that a fraction of the cost to the state in Housing benefit and B&B costs for the homeless could actually economically buy back a lot of housing – I don’t know the answer to that – but it is worth asking!

Dave Parks

Hi

Tim O passed your e-mail to me, hope my reply rings some bells.

I don’t know the answer to your first question, but it is a distraction to scapegoat “evil private landlords” for our housing problems; the problems are entirely due to the last 30 years of housing policy, which uses housing benefit to subsidise our private rented consumer service.

Average house price of £237,000 in the S.E. is 10 to 16 times average local salaries [1]. Two and a half times income is considered a sensible limit for a loan, so too expensive to buy, for sure. By almost the same amount, it is also too expensive to rent. A 10% return on capital investment would require a rent of 23700/52 = £456/wk; actually more than the cost of a mortgage to buy. This is the reason that huge housing benefit subsidies are required (£16640 – 19300 per year [2]) and it is the consequence of a policy to enforce rents that conform to a private rented consumer service. In the days of council housing, there was an alternative. After an initial period of investment subsidy, the growth of equity in the ‘public’ housing stock was used to fund low rents on a cost balanced budget. In effect the investment subsidy matured and it created a low rent stock that no longer required subsidy; this occurred for most authorities towards the end of the 1960s.

But Conservative belief in the magical benefits of a property owning democracy, led them to pursue unrealistic and inconsistent housing policies. They believed that any type of low cost rented alternative would defeat their aim to achieve 100% home ownership, a belief that verged on the fanatical, by ignoring the reality that about a third of all incomes have remained below the level required to support a mortgage loan. In three major reforms (1953, 1972, 1980) they concentrated on the revival of the private rented sector, which was rapidly declining, largely due to council housing. The earlier reforms failed, until Mrs Thatcher struck at the heart of the problem by eliminating the low cost rented sector more directly. The right-to-buy law removed the low cost alternative to the private rented consumer service. First, by transferring them to the private ownership sector; selling them with the huge incentive of up to 70% discounts. Secondly, by using the discounts to eliminate the equity and the future growth of equity in the stock; thus enforcing the rise of rents necessary to support a stock stripped of equity and therefore equivalent to a rented consumer service.

The market responded badly to all of these reforms. To achieve their imaginary dream, the right wing ‘free market’ party lost the plot, they massively distorted the housing market with huge rent and property sale discounts. Currently, we have high unstable house prices, 46% of emerging households believe they will never be able to buy their own house, unsustainable housing benefit, the poverty trap of social housing and the increasingly isolated property-less poor.

Labour has no housing policy because it is trapped in a 30-year time warp by the alleged popularity of the right to buy. To recover some perspective it is best to remember that the production of housing is very cheap, when measured over the period of its consumption. Typically it takes us 25 years to buy them, but they can last for 200 years [3]. This makes the costing of a rented stock at least 6 times cheaper than a private rented consumer service. It is also well to remember that housing policy usually takes 25-30 years to mature.

For a mind-blowing graphical answer to question 2, scroll just over half way down the web page in footnote 3 and look for “Subsidy Comparison for Evolution to Mature Stock”.

1. BBC 6.30 News 6th Dec 2011

2. Calculated from ‘affordable’ 30% of local salaries inferred by the BBC

announcement

3. http://www.ukhousingpolicy.com/