A highly amusing article from Business Insider UK about the Greek Debt Crisis and how the EU deliberately engineered the crisis by taking over the debt owed to private banks onto the shoulders of European tax payers.

It is an even greater reason why the Greeks should junk the debt and leave the Euro.

Below is also my Comment article that The Argus, a local Brighton/Sussex paper prints each week.

Tony Greenstein

GREECE JUST TAUGHT CAPITALISTS A LESSON ABOUT WHAT CAPITALISM REALLY MEANS

Jim Edwards Jul. 5, 2015

Greece has effectively voted to default on its debt to the International Monetary Fund (IMF) and the European Union, and it is a massive defeat for Germany’s Angela Merkel and the trio of creditors she led that insisted there was no way out for Greece but to pay back its massive debts.

The vote is huge lesson for conservatives and anyone else who thinks this is about a dilettante government of left-wing idealists who think they can flout the law while staging some kind of Che Guevara-esque dream:

Wrong.

This is what capitalism is really about.

From the beginning, Merkel and the EU have operated from the position that because Greece took on debt, Greece now needs to pay it back. That position assumed — bizarrely, in hindsight — that debt works only one way: If you lend someone money, that money is repaid.

But that is NOT how free markets work.

Debt is not a guarantee of future payments in full. Rather, it is a risk that creditors take, in hopes of maybe being paid tomorrow.

The key word there is “risk.”

If you’re willing to take the risk, you’ll get a premium — in the form of interest.

But the downside of that risk is that you lose your money. And Greece just called Germany’s bluff.

The IMF loaned Greece 1.5 billion euros, due back in June, and Greece isn’t paying it back. Greece has another 3.5 billion due to the ECB in July, and that looks really doubtful right now.

This is how capitalism works. The fact that it took a democratically elected government whose own offices are adorned with posters of Lenin, Engels, and Guevara to teach this lesson to Germany is astonishing.

More astonishing still is that Merkel et al knew Greece could not pay back this debt before these negotiations started. The IMF’s own assessment of Greek debt, published just a few days ago, states: “Coming on top of the very high existing debt, these new financing needs render the debt dynamics unsustainable …”

“Unsustainable”! Germany’s own bankers knew Greece couldn’t pay this back. And yet Merkel persisted.

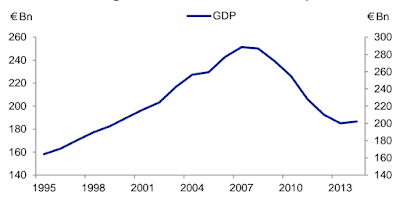

Take a look at Greek gross domestic product. To pay back debt, you have to have a growing economy. That’s a basic law of economics. It’s how credit cards work. It’s how mortgages work. And it is how sovereign/central-bank debt works. But Greece’s economy was never in a position to benefit from debt, because it has been shrinking for years:

Goldman Sachs

There is another key fact that the Greeks are keenly aware of (but that everyone else has forgotten).

This debt was initially owed to private-investment banks, such as Goldman Sachs. But the IMF and the European Central Bank (ECB) made the suicidal decision to let those private banks transfer that debt to EU institutions and the IMF to “rescue” Greece. As Business Insider reported back in April, former ECB president Jean-Claude Trichet insisted that the debt transfer take place:

The ECB president “blew up,” according to one attendee. “Trichet said, ‘We are an economic and monetary union, and there must be no debt restructuring!'” this person recalled. “He was shouting.”

The result was that the ECB made this catastrophically stupid deal with Greece, according to our April report:

And so there was no restructuring agreed for Greece. The country paid off its immediate debts to the private financial sector — investment banks, basically — and replacement debt was laid onto European taxpayers. The government agreed to a package of harsh government spending cuts and structural reforms in exchange for loans totalling €110 billion over three years.

Trichet made a colossal, elementary mistake. The right place for risky debt by definition is in the private markets, such as Goldman. The entire point of private debt investment is that those creditors are prepared for a haircut. The risk absolutely should not be borne by central banks that rely on taxpayer money for bailouts.

Had Trichet made the opposite decision — and left the Greek debt with Goldman et al — then Sunday’s vote would be a footnote rather than a headline in history. “Goldman Sachs takes a bath on Greek debt.” Who cares? Goldman shareholders and clients, surely. But it would not have triggered a crisis at the heart of the EU.

Italy, Spain, and Portugal are now watching Greece closely and thinking, hey, maybe we can get out of this mess, too.

Now, before we all start singing “The Red Flag” and breaking out old videos of “The Young Ones” in celebration, let’s inject a note of realism. Greece isn’t actually a country full of crazy socialists who don’t understand how the foreign-exchange markets work. In fact, a huge chunk of the country’s tax-collection problems stem from the fact that there are two and a half times more self-employed and small-business people in Greece than there are in the average country. And small businesses are expert at avoiding tax, Greece’s former tax collector told Business Insider’s Mike Bird recently.

Conservatives who hate paying taxes and urge small businesses to pursue tax-avoidance strategies take note: Your dream just came true in Greece.

If Greece were more socialist — more like Germany, with its giant corporations that have massive unionised workforces paying taxes off their payrolls — then tax collection would be a lot higher in Greece.

Greece is now most likely an international pariah on the debt markets. It may have to start printing its own devalued drachma currency. It will have no access to credit. Sure, olive oil, feta, and raki will suddenly become incredibly cheap commodities on the export markets. Tourism in Greece is about to become awesome. But mostly it will be awful. Unemployment will increase as Greece’s economy implodes.

But the awfulness will be Greece’s alone. Greece is now on its own path. It is deciding its own fate.

There is something admirable about that.

Posted in Blog