|

| Royal Parasites – (no not the British ones!) Saudi Interior Minister Prince Nayef bin Abdul Aziz (left) with his son and deputy Prince Mohammed in the Saudi holy city of Mecca. (AFP/Getty Images) |

The shifting sands of Arabia will become the graveyard of Western oil policy

It’s not often that I blog with a Telegraph article. Known as the Torygraph, it isn’t quite my cup of tea! However if the article below is true, then there are serious problems ahead in terms of the Middle East as a major oil exporter, not least because Saudi Arabia is the world’s largest oil producer.

What has been created in Saudi Arabia is a wholly artificial society, with foreign labour doing most of the donkey work (without rights under ‘Islamic justice’). But as with any hireling, the Saudi ruling monarchy that the United States and Standard Oil plucked from the desert, has become wasteful, corrupt and self-serving. Following the logic of capitalism they have consumed today and waited for tomorrow. Planning ahead, tapping the vast amounts of solar energy, reducing wasteful energy expenditure, has not even been considered.

Air conditioning was never needed when stone houses were built in such a way that even during the hottest summer they were cool, with water providing an additional coolant. Western style apartments of course need air conditioning.

But more importantly than just Saudi Arabia is that the whole energy crisis is a monumental tribute to the abysmal failures of capitalism. There is no possibility of sensible planning ahead when the elites that control society think only in terms of their own interests. In Saudi Arabia, a key lynch-pin for the US in the Middle East and an ally (of course unofficially) with Israel, the ruling House of Saud is over 2,000 strong. Islamic law prevents women driving but not the princes gambling away millions each year in western casinos or buying prostitutes.

The same, of course, is even more true of the sparsely populated emirates of the UAR, Dubai and Abu Dhabi. There elites control the vast oil wealth and squander it with no accountability, knowing full well that any challenge to their domination will be met with fierce repression, as in Bahrain, encouraged and supported by the US. Bush’s ‘war for democracy’ always stopped short at the shoreline of Saudi Arabia and the Gulf. Their main fear was and is Iran. As Wikileaks showed, Saudi Arabia’s ruling elite were more than prepared to allow Israeli planes to overfly the kingdom, whilst of course denying any such agreement.

And what are the consequences for Israel? Not good. If there is little oil to protect and none that is exportable, then there is a less urgent need to support Israel as the bastion of security in a region whose economic usefulness is coming to an end.

Tony Greenstein

|

| Ambrose Evans-Pritchard |

Ambrose Evans-Pritchard has covered world politics and economics for 30 years, based in Europe, the US, and Latin America. He joined the Telegraph in 1991, serving as Washington correspondent and later Europe correspondent in Brussels. He is now International Business Editor in London.

By Ambrose Evans-Pritchard Energy September 5th, 2012

If Citigroup is right, Saudi Arabia will cease to be an oil exporter by 2030, far sooner than previously thought.

A 150-page report by Heidy Rehman on the Saudi petrochemical industry should be sober reading for those who think that shale oil and gas have solved our global energy crunch.

I don’t wish to knock shale. It is a Godsend and should be encouraged with utmost vigour and dispatch in Britain. But it is for now plugging holes in global supply rather than covering the future shortfall as the industrial revolutions of Asia mature.

The basic point – common to other Gulf oil producers – is that Saudi local consumption is rocketing. Residential use makes up 50pc of demand, and over two thirds of that is air-conditioning.

The Saudis also consume 250 litres per head per day of water – the world’s third highest (which blows the mind), growing at 9pc a year – and most of this is provided from energy-guzzling desalination plants.

All this is made far worse across the Gulf by fuel subsidies to placate restive populations.

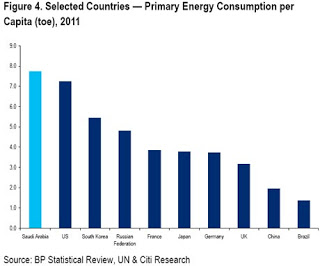

The Saudis already consume a quarter of their 11.1m barrels a day of crude output. They are using more per capita than the US even though their industrial base as a share of GDP is much smaller.

The country already consumes all its gas. (Neighbouring Kuwait is now importing LNG gas from Russia:

From Heidy Rehman at Citi:

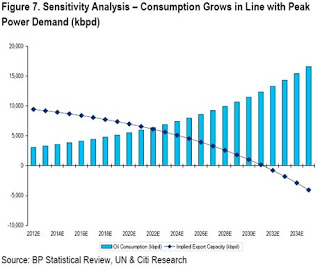

• Saudi Arabia Could be an Oil Importer by ~2030 — Saudi Arabia is the world’s largest oil producer (11.1mbpd) & exporter (7.7mbpd). It also consumes 25% of its production. Energy consumption per capita exceeds that of most industrial nations. Oil & its derivatives account for ~50% of Saudi’s electricity production, used mostly (>50%) for residential use. Peak power demand is growing by ~8%/yr. Our analysis shows that if nothing changes Saudi may have no available oil for export by 2030.

• It Already Consumes All Its Gas Production — Saudi Arabia produces 9.6bn ft3/day of natural gas. This is entirely consumed domestically. It is looking to raise gas production to 15.5bn ft3/day by 2015E, implying a 2011-15E CAGR of 12.7%. However, peak power demand is growing at almost 8% pa. We believe Saudi Arabia will need to find new sources to meet residential & industrial demand.

This may concentrate a few minds in The Kingdom. The country is already planning an 80GW nuclear blitz though they are woefully short of nuclear power experts.

It has big hopes from solar projects based on successes of solar farms in California. Both nuclear and solar would allow it export more of its oil output.

A great deal could change. New desalination filters should reduce energy use drastically, for instance. Saudi fuel subsidy policies may change.

While I don’t wish to judge the claims of this report – I merely pass it on to readers since I don’t know enough about the Saudi system – but it is yet another piece of evidence pointing to Peak Cheap Oil.

Jeremy Leggett, the head of the UK Taskforce on Peak Oil and Energy Security, says Britain is sleepwalking into a potential disaster by failing to prepare fully for a global supply crunch.

The refusal to listen to warning signals is comparable to the complacency in the build-up to the financial crisis, he argues, but with graver implications for the British economy.

I agree.